The Opportrade team has built a Momentum Breakout Strategy with Trend Filter. This strategy is designed to capture the strongest and most confirmed bullish movements in trending markets, using the MACD indicator and a filter based on the 25-period Exponential Moving Average (EMA).

In this article, we will explain how the strategy works, which markets are best suited to apply it, and share the results of a backtest. Additionally, you can download the strategy template for FREE from our Marketplace, test it on your assets, and discover how to optimize your trading.

The strategy enters a position when the MACD line crosses the zero line from below, signaling a shift towards bullish momentum. This ensures that the strategy only opens long positions when there is a clear upward trend reversal.

To increase the probability of success, the strategy only enters a position when the price is above the 25-period Exponential Moving Average (EMA), confirming that the market is in an uptrend. This filter ensures that only trades in a growing market are taken, avoiding sideways or bearish markets.

The position is closed when the MACD line crosses below the signal line. Additionally, a filter is applied to the current closing price, which must be below the 25-period Exponential Moving Average (EMA). This exit signal helps protect gains in case the market reverses direction quickly.

The strategy was optimized on Bitcoin/USD (XBT/USD in Opportrade, as we use the technical name for Bitcoin). We chose an order size based on the asset quantity, set at 0.33 BTC, which is intentionally contained given Bitcoin's high value.

We also set an exposure limit equal to the order size (0.33 BTC), ensuring that the position does not grow beyond this limit.

Of course, the order sizing and exposure limits should be adjusted if you want to use the strategy with an asset other than Bitcoin or if you want to use an initial capital smaller than the 10,000 USD used in our backtest.

This strategy is relatively conservative and aims to capture only the strongest and most confirmed bullish movements. The EMA(25) filter ensures that trades are only made in uptrends, reducing the risk of trading during sideways or uncertain markets. The strategy aims to generate returns at least comparable to the market, but it does not aim to outperform the market (which is quite difficult considering Bitcoin's high returns over the past two years). At the same time, the strategy aims to have more contained drawdowns compared to a Buy & Hold philosophy, as well as reducing the time spent with open positions.

In terms of operations, a balance has been sought between a total number of trades that ensures statistical significance and relatively low commission costs.

This strategy is perfect for high-volatility markets such as cryptocurrencies (Bitcoin, Ethereum) on 1h to 4h timeframes. It is particularly effective in trending markets, where decisive movements dominate, and during periods of high liquidity, with markets moving upward in a clear direction. It performs best in low-volatility environments with smoother price movements, rather than in sideways or uncertain markets.

We tested the strategy and optimized the order sizing for Bitcoin/USD. Below are the key details about the dataset and the backtest settings:

Asset Tested: Bitcoin/USD (XBT/USD)

Test Period: August 20, 2023 - August 20, 2025

Candle Size: 1 hour

Initial Capital: 10,000 USD

Commission: 0.1% of each order's value

Spread: 0% (ignored due to Bitcoin's extremely high liquidity)

Leverage Trading: No (we kept a Margin Required equal to 100% of the position's value)

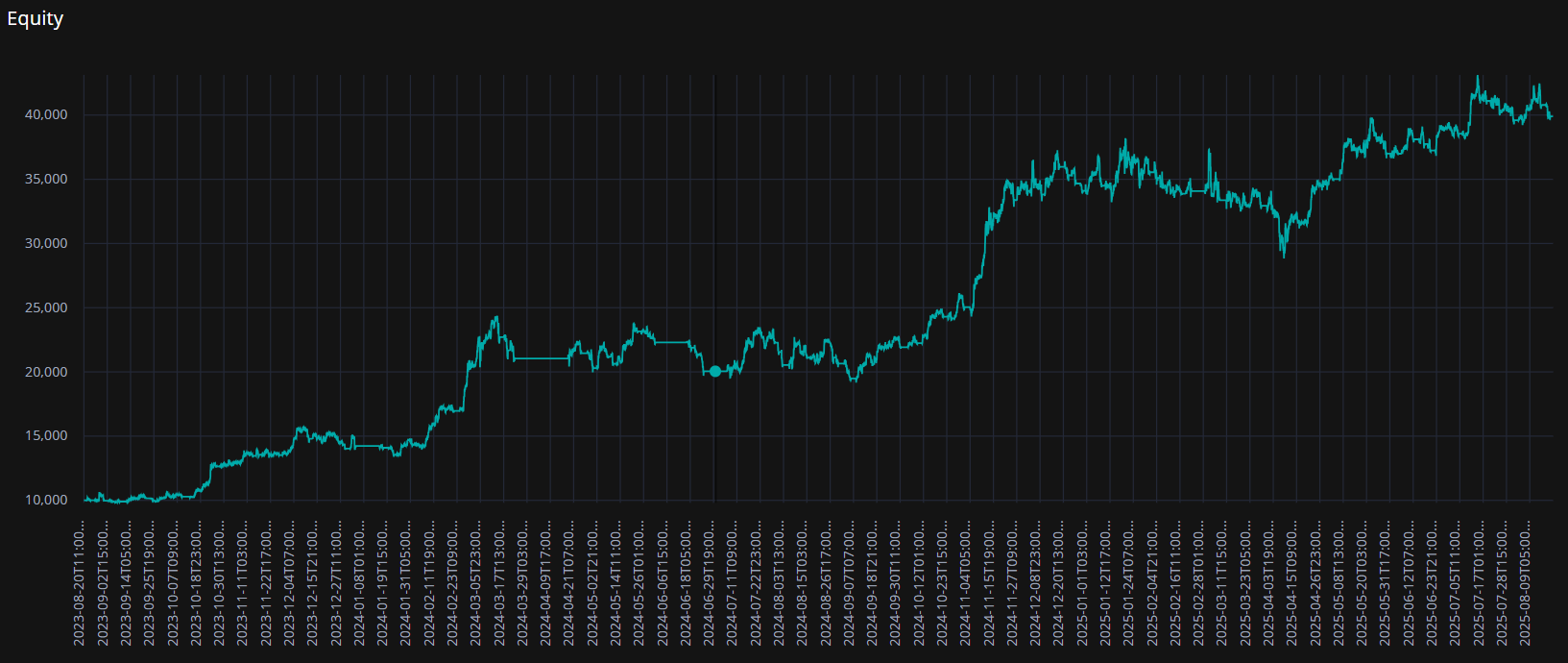

Despite the 0.1% commission, the strategy performed quite well during the test, accumulating a total return of 299%, compared to the market's performance of 333%. Given the impressive returns of BTC over the same two-year period, this is certainly a notable result. As mentioned earlier, the goal of this strategy wasn't to outperform the market (which is very difficult in the crypto world) but to approximate market returns while ensuring a lower drawdown and spending less time with open positions.

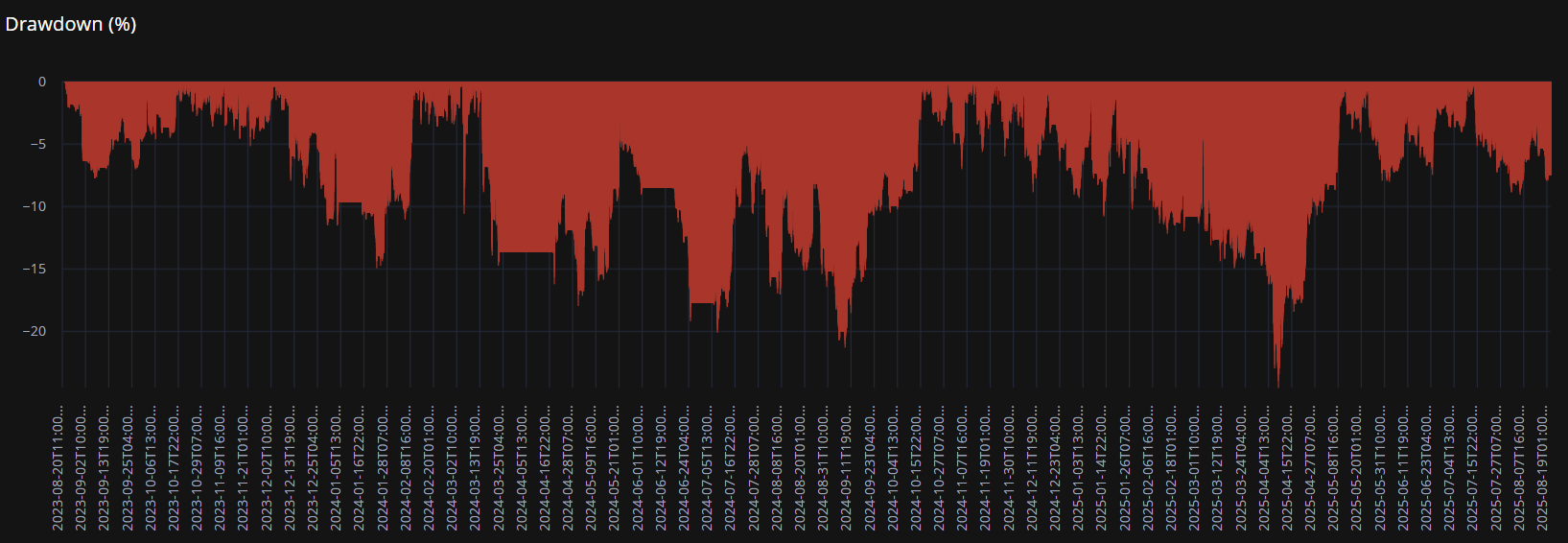

Even in terms of drawdown, the strategy performed decently, although managing drawdown in volatile markets like crypto is never guaranteed. The maximum drawdown was 24.50%, compared to a 32% maximum drawdown from a "Buy & Hold" approach.

Here are the main metrics from our backtest:

Initial Capital: 10,000 USD

Final Capital: 39,904.05 USD

Total Return: 299%

Profit (gross of fees): 35,078.21 USD

Total Fees Paid: 5,174.16 USD

Maximum Drawdown: 24.50%

Total Number of Orders: 218

Average Monthly Orders: 9

Number of Winning Exits: 50

Number of Losing Exits: 59

Percentage of Time with Open Positions: 73.64%

Sterling Ratio: 5.72

Calmar Ratio: 4.07

Below you will find the equity line and drawdown line.

Equity Line

Drawdown line

Has our Momentum Breakout strategy caught your interest?

Download it for FREE from our marketplace, test it on your preferred asset, and let us know how you optimized it!